Loading...

10%

Shuchita Solved Scanner CA Final Paper-5 IDT By Prof. Arun Kumar Jan 26 Exam

₹436M.R.P.: ₹485

save ₹49 (10%)

Free delivery on orders above ₹750

1

Free Delivery

On orders above ₹750

2 Days Return

Easy returns & refunds

Cash on Delivery

Pay when you receive

Secure Payment

100% secure transactions

Certified Product

Authentic & verified

Product Details

ISBN-13

9.78936E+12

Publisher

shuchita prakashan

Language

English

Weight

478 grams

Edition

76th Edition Oct 2025

About the Book

Shuchita Solved Scanner CA Final Paper-5 IDT By Prof. Arun Kumar Jan 26 Exam

Shuchita Solved Scanner CA Final Paper-5 IDT By Prof. Arun Kumar Jan 26 Exam

Content

- Supply Under GST

- Charge of GST

- Place of Supply

- Exemptions from GST

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice, Credit and Debit Notes

- Account and Records: E Way Bill

- Payment of Tax

- Electronic Commerce Transaction under GST

- Returns

- Import and export under GST

- Refunds

- Job work

- Assessment and Audit

- Inspection, Search. Seizure and Arrest

- Demand and Recovery

- Liability to Pay in Certain Cases

- Offences and Penalties and Ethical Aspects under GST

- Appeals and revisions

- Advance Ruling

- Miscellaneous Provisions

Part-ll Customs and FTP

- Levy and Exemptions from Customs Duty

- Types of Duty

- Classification of Imported and Exported Goods

- Valuation under the Customs Act. 1962

- Importation and Exportation of Goods

- Warehousing

- Refund

- Foreign Trade Policy

No reviews yet. Be the first to review!

Related Books

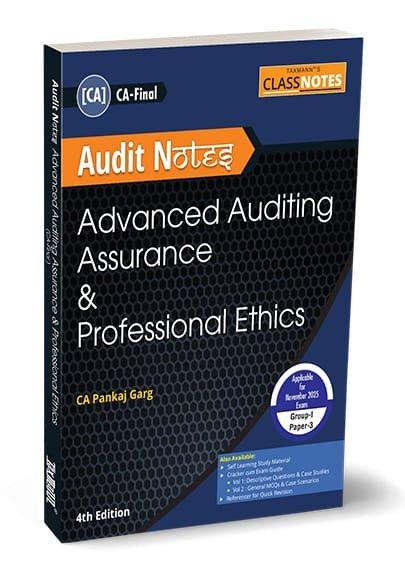

CA Final Audit Class Notes By CA Pankaj Garg 5th Edition Nov 25 For Jan 26 Exam

by CA Pankaj garg

₹955₹1195

CA Final Audit Main Book and Question Bank CA Abhishek Bansal Sep 25 / Jan 26 Exam

by Abhishek Bansal

₹1390₹1990

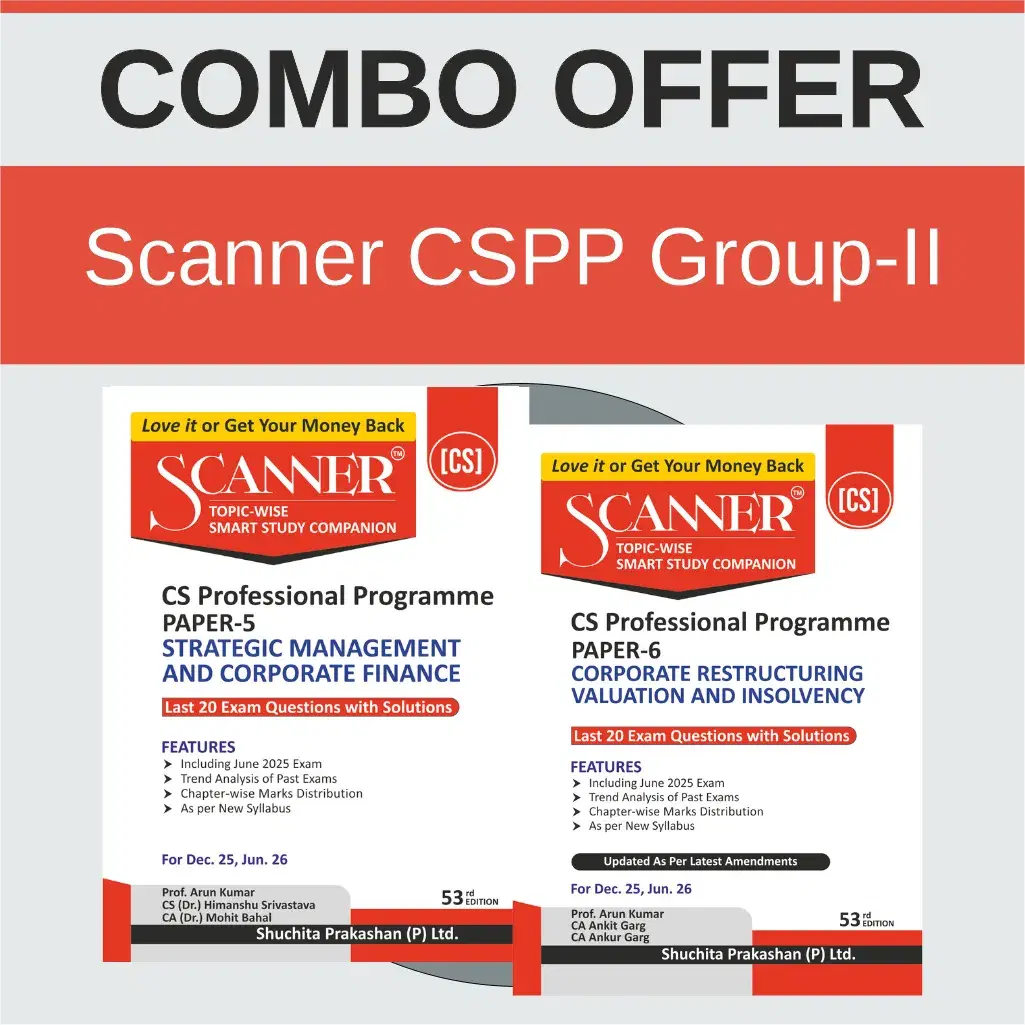

Shuchita Solved Scanner CS Professional Group 2 (Paper 5,6) Dec 25 Exam

by Arun Kumar

₹805₹950

Shuchita Solved Scanner's CS Professional Group I Dec 25 Exam

by Arun Kumar

₹930₹1095

Bharat CA Inter Taxation MCQ Booklet By CA. Arvind Tuli Applicable for May / Sep 2025 Exam

by CA. Arvind Tuli

₹315₹395

CA Final Audit Cracker By CA Pankaj Garg Jan 26 Exam

by CA Pankaj garg

₹1220₹1695

CA Final Audit Class Notes By CA Pankaj Garg Sep 25 / Jan 26 Exam

by CA Pankaj garg

₹925₹1195

Taxmann's Entrepreneurship & New Venture Planning Dr. Vandana Jain Edition 2025

by Vandana Jain

₹396₹495