Formation, Management, and Taxation of Partnership Firms and Partners

save ₹150 (20%)

Free Delivery

On orders above ₹750

2 Days Return

Easy returns & refunds

Cash on Delivery

Pay when you receive

Secure Payment

100% secure transactions

Certified Product

Authentic & verified

Product Details

About the Author

Ram dutt sharma was born on 27th June, 1958 in Narnaul, Haryana. He got his post-graduate from M.D. University, Rohtak in 1980. He Join the Income Tax Department in the year 1983 and retired as Income Tax Officer on 30-06-2018, He Worked at Various Stations of North-West Region of Income Tax Department. He has wide Experience of all wings of Income Tax Department such as Assessment Units Special Range, TDS Wing, Investigation Wings etc. He has been Contributing articles and addressing on Topics Relating to Income Tax at NADT Regional Campus, Chandigarh & Bhopal. He has also addressed number of seminars Organized by the Income Tax Department, Chartered Accountants Advocate and various Trade Associations.

About the Book

Formation Management and Taxation of Partnership Firms and Partners

Authored by Ram Dutt Sharma, this 2nd Edition (2023) provides an in-depth and practical analysis of the law relating to the formation, administration, and taxation of partnership firms and partners in India. It is meticulously updated in accordance with the Partnership Act, 1932 and the Income Tax Act, 1961, making it an essential reference for practitioners, academicians, and students.

The book comprehensively explains the legal and procedural framework for establishing and managing a partnership firm, including rights, duties, and liabilities of partners. It also covers the complete taxation regime applicable to partnership firms and their partners, integrating statutory provisions with judicial interpretations and departmental guidelines.

The content covers:

• Concept, nature, and characteristics of partnership

• Formation and registration of partnership firms under the Partnership Act, 1932

• Rights, duties, and obligations of partners

• Dissolution and reconstitution of firms

• Taxation provisions applicable to partnership firms under the Income Tax Act, 1961

• Computation of taxable income and filing of returns for partnership firms

• Remuneration to partners – allowable limits and tax treatment

• Interest on capital and drawings – accounting and taxation aspects

• Assessment procedures and compliance requirements for firms and partners

• Set-off and carry forward of losses

• Recent amendments and latest case laws relevant to partnership taxation

• Practical illustrations for clarity in computation and compliance

This edition is particularly suitable for:

• Chartered accountants, tax practitioners, and advocates handling partnership matters

• Business owners and partners seeking clarity on legal and tax implications

• Students of law, commerce, and taxation preparing for professional exams

• Academicians and researchers focusing on business law and taxation

With its blend of legal interpretation, procedural guidance, and practical examples, this edition stands as a reliable resource for understanding and managing the complexities of partnership law and taxation in India.

No reviews yet. Be the first to review!

Related Books

Taxmann Indian Accounting Standards & Corporate Accounting Practices By T P Ghosh 10th Edition Nov 2025

by T P GHOSH

Taxmann GST Appeals & Appellate Tribunal By CMA Dipak N Joshi 1st Edition Dec 2025

by CMA DIPAK N JOSHI

Commercial Income Tax Act 2025 by CA Girish Ahuja 1st Edition 2025 Commercial Income Tax Act 2025 by CA Girish Ahuja 1st Edition 2025

by Girish Ahuja & Ravi Gupta

Book Corporation Compendium on GST By Vivek Jalan , S.K. Panda 1st Edition Dec 2025

by Vivek Jalan

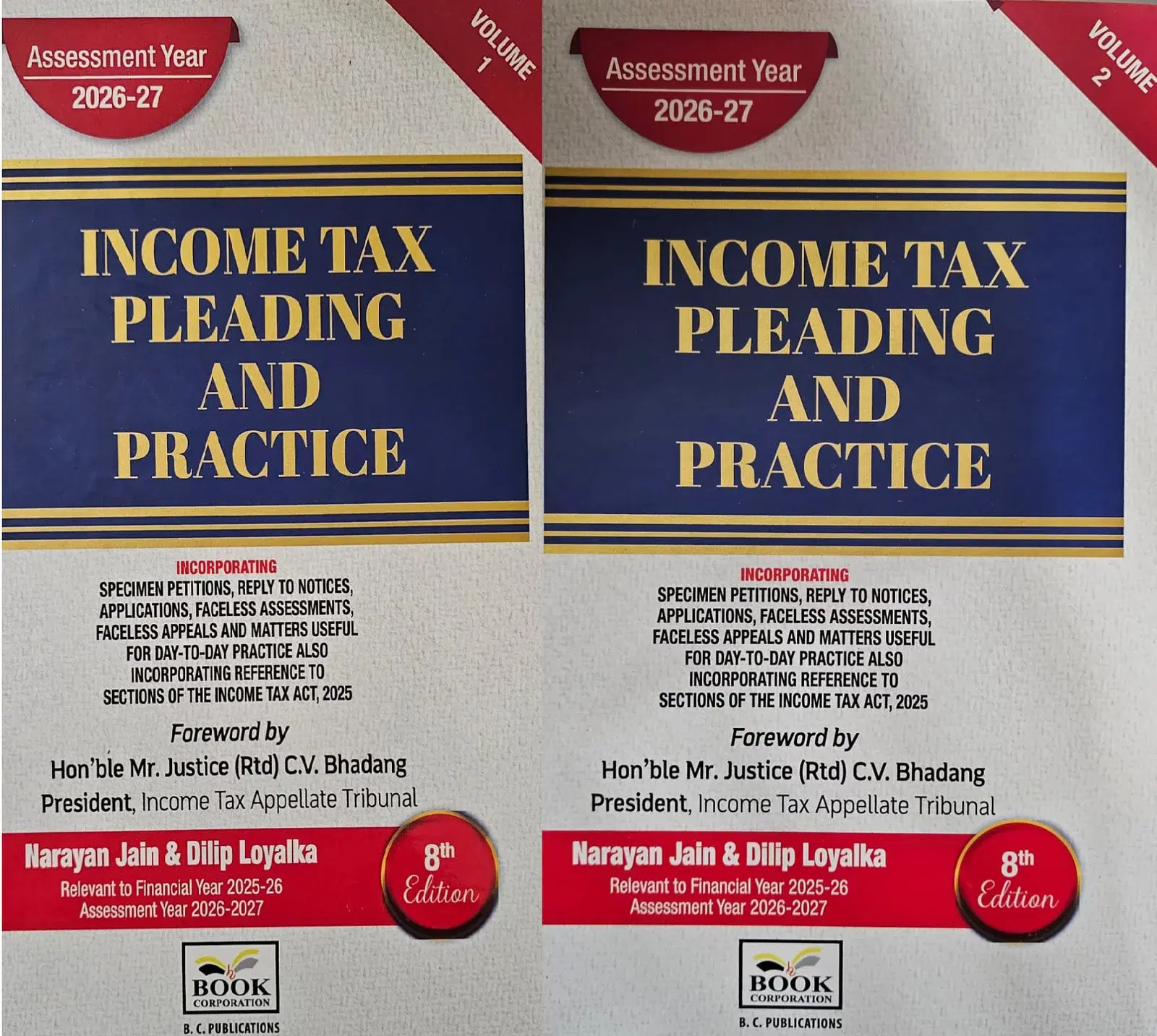

Book Corporation’s Income Tax Pleadings and Practice by Narayan Jain & Dilip Loyalka 8th Edition Dec 2025

by Narayan Jain

Handbook of Company Law Procedures

by Mr. Vinod Kumar Aggarwal

Master Guide to GST ACTS - Vols. 1 & 2

by Dr. Avinash Poddar

Handbook on Drawback of Duties & Taxes

by R Krishnan