Methods of Investigations of Books of Accounts and Other Documents

save ₹259 (20%)

Free Delivery

On orders above ₹750

2 Days Return

Easy returns & refunds

Cash on Delivery

Pay when you receive

Secure Payment

100% secure transactions

Certified Product

Authentic & verified

Product Details

About the Author

Ram dutt sharma was born on 27th June, 1958 in Narnaul, Haryana. He got his post-graduate from M.D. University, Rohtak in 1980. He Join the Income Tax Department in the year 1983 and retired as Income Tax Officer on 30-06-2018, He Worked at Various Stations of North-West Region of Income Tax Department. He has wide Experience of all wings of Income Tax Department such as Assessment Units Special Range, TDS Wing, Investigation Wings etc. He has been Contributing articles and addressing on Topics Relating to Income Tax at NADT Regional Campus, Chandigarh & Bhopal. He has also addressed number of seminars Organized by the Income Tax Department, Chartered Accountants Advocate and various Trade Associations.

About the Book

Methods of Investigations of Books of Accounts and Other Documents

This 2024 edition of Methods of Investigations of Books of Account and Other Documents by Ram Dutt Sharma is a detailed and practical guide for understanding investigative techniques in the context of tax compliance, accounting accuracy, and detection of financial irregularities. Designed for professionals engaged in auditing, taxation, and enforcement, this book bridges the gap between statutory requirements and practical investigative approaches.

The book provides a systematic framework for examining books of account and related records to uncover discrepancies, ensure compliance with tax laws, and detect fraud or misrepresentation. It reflects the latest statutory provisions and procedural updates as of 2024.

The content covers:

• Objectives and scope of investigations in accounting and taxation

• Legal framework and powers of investigation under tax laws

• Preliminary steps in planning and initiating an investigation

• Examination of ledgers, journals, cash books, and supporting vouchers

• Cross-verification with external records and third-party confirmations

• Methods of detecting manipulation of accounts and falsification of documents

• Identification of unrecorded transactions, suppression of sales, and inflation of expenses

• Use of technology and digital forensics in accounting investigations

• Analysis of bank statements, stock registers, and statutory filings

• Common red flags indicating financial irregularities

• Evidentiary requirements and proper documentation of findings

• Preparation of investigation reports and follow-up actions

• Case studies illustrating practical challenges and solutions in investigations

This edition is particularly useful for:

• Chartered accountants, forensic auditors, and tax consultants

• Income-tax officials and enforcement officers conducting investigations

• Corporate compliance officers and internal auditors

• Law students and academicians studying forensic accounting and tax procedures

With its blend of statutory guidance, investigative methodology, and real-world illustrations, Methods of Investigations of Books of Account and Other Documents serves as a comprehensive reference for ensuring transparency, accountability, and compliance in financial record-keeping.

No reviews yet. Be the first to review!

Related Books

Taxmann Indian Accounting Standards & Corporate Accounting Practices By T P Ghosh 10th Edition Nov 2025

by T P GHOSH

Taxmann GST Appeals & Appellate Tribunal By CMA Dipak N Joshi 1st Edition Dec 2025

by CMA DIPAK N JOSHI

Commercial Income Tax Act 2025 by CA Girish Ahuja 1st Edition 2025 Commercial Income Tax Act 2025 by CA Girish Ahuja 1st Edition 2025

by Girish Ahuja & Ravi Gupta

Book Corporation Compendium on GST By Vivek Jalan , S.K. Panda 1st Edition Dec 2025

by Vivek Jalan

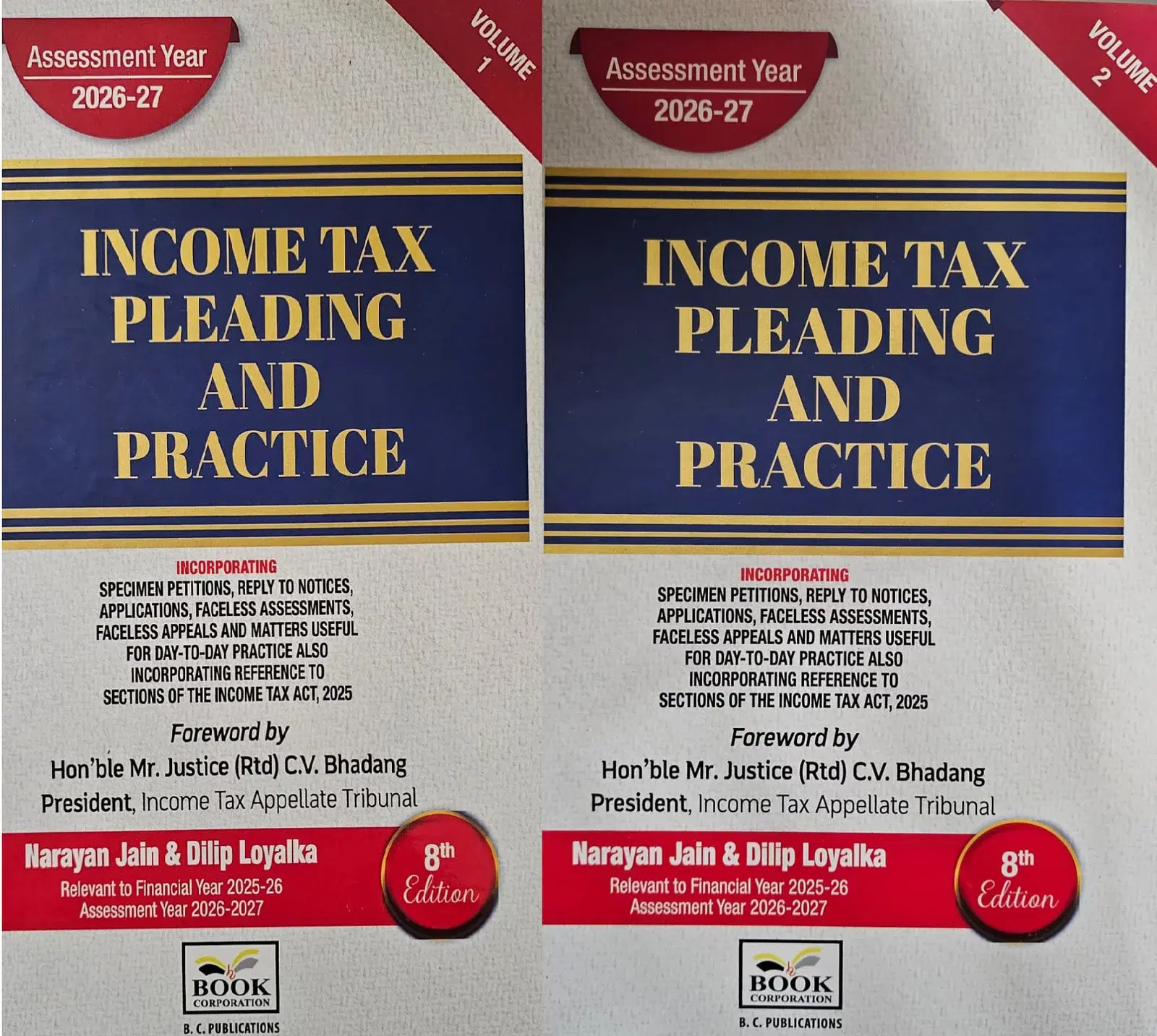

Book Corporation’s Income Tax Pleadings and Practice by Narayan Jain & Dilip Loyalka 8th Edition Dec 2025

by Narayan Jain

Handbook of Company Law Procedures

by Mr. Vinod Kumar Aggarwal

Master Guide to GST ACTS - Vols. 1 & 2

by Dr. Avinash Poddar

Handbook on Drawback of Duties & Taxes

by R Krishnan